The Smart Expert Guide to Buying a House In Kenya – 2025

Owning a home in Kenya feels huge. It’s the kind of decision that sticks with you. We’ve seen just how much thought people put into it, such as what’s affordable and what actually feels like home. We built this guide for that exact reason. Not to flood you with generic advice, but to walk you through the things that really matter once you start looking.

We will guide you through every stage, which includes setting a budget, finding the perfect property, running title searches, and signing the required documents. There is information in here that will help you if you are a first-time buyer or an investor from abroad.

It’s also packed with insights for anyone interested in buying homes to rent out, or those based overseas.

The Real Estate Kenya Landscape

The Kenyan real estate market is one that keeps on growing. New highways link satellite towns to Nairobi. You can pick an apartment near the city centre, a townhouse in a gated community, a bungalow on half an acre, or a piece of land for future building.

Prices do change depending on the area. A two-bed flat in Ruaka may cost around KSh 8 million, but a larger house can start at KSh 12 million.

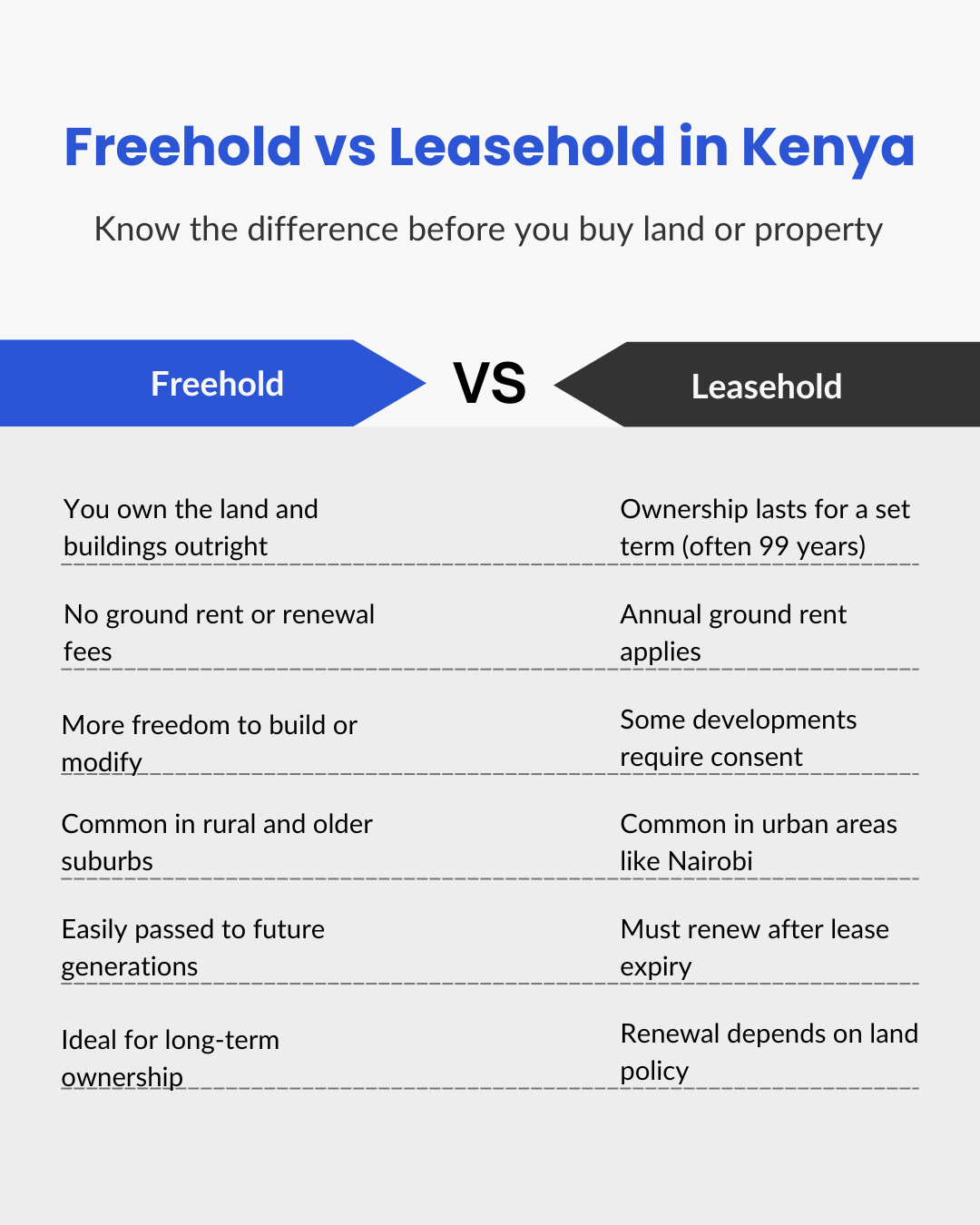

There is steady demand from Kenyans living overseas, which is helped by easier mortgage access, as most banks now offer diaspora loans and rate discounts for salaried buyers. Kenyan home ownership comes in two main forms (which we will discuss in more detail later). Freehold gives you the land to keep, and leasehold grants long-term rights, with ground rent due each year. Knowing which title sits behind your dream home matters.

Freehold vs Leasehold. What Are You Buying?

In Kenya, not all land ownership means the same thing. Buyers often fall in love with a Kenyan property only to back out once they realise the title comes with conditions they didn’t expect. That’s why it helps to understand this part early on.

Freehold

This means you own the land outright with no renewal dates and no ground rent. It’s more common in rural areas and some older suburbs.

Leasehold

This grants you long-term rights (typically 99 years), but the government or a private entity technically owns the land. Most leasehold plots, especially in towns and cities, come with rules. You’ll likely pay annual rent to the Ministry of Lands and need official consent before reselling or developing.

Freehold and Leasehold titles both work, but they’re not the same. Leasehold comes with extra steps, like annual rent and approval processes. Sometimes, buyers skip this part and end up stuck. A simple title search early on clears up most of that. You can read a more detailed guide on freehold vs leasehold in Kenya.

Preparing Your Finances

Before you start viewing homes, get clear on what you can afford without putting pressure on your daily life. Work out your reliable monthly income, take stock of your savings, and decide how much you’re comfortable spending. A clear budget makes the search much easier. It also helps you find good options faster and avoid falling for homes that look great but would stretch your finances too far.

Next, build your deposit. Lenders usually expect at least 10% of the price, and a 20% trims repayments. Rates jump around. Some banks were offering just under 8% last month, others were higher. Best to speak to a lender early and find out where you stand. Pre-approval helps when it’s time to negotiate.

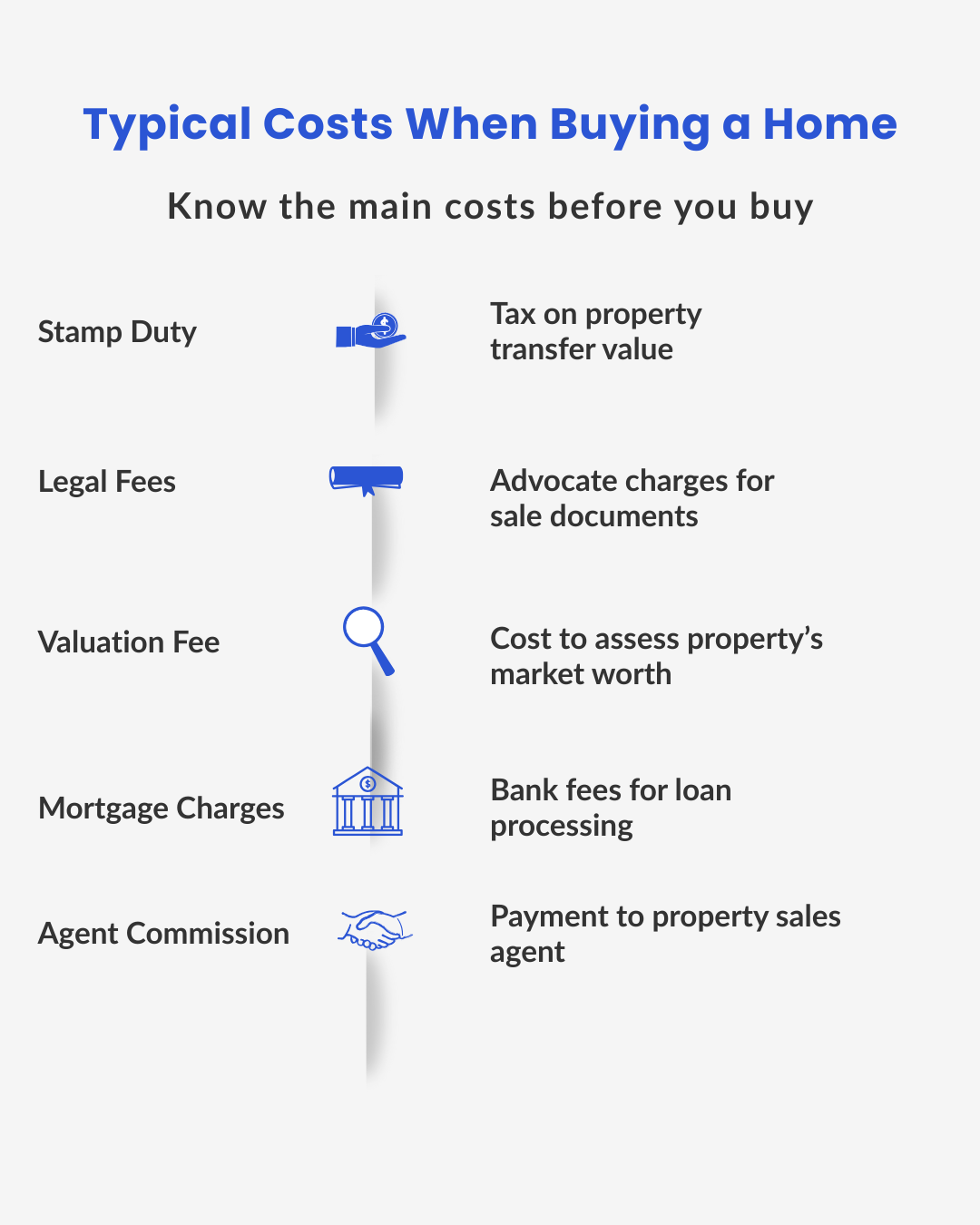

Don’t just focus on the house price. Legal fees, stamp duty, moving costs, they all add up.

- Stamp duty – 2% to 4% of the agreed price, paid to the Kenya Revenue Authority.

- Legal fees – roughly 1% to 2% to cover conveyancing by a licensed advocate.

- Title search and registration – about KSh 500 for the search plus modest filing charges.

- Valuation and survey – the bank may require an independent valuer.

- Mortgage processing – the lender charges for the application, appraisal, and insurance during mortgage processing.

- Home cover, moving, and first-week repairs – small items that pile up fast.

Finally, choose your payment route. Cash buyers avoid debt and can win price cuts, yet they lock up capital. Mortgages spread the cost but add interest and paperwork. List your priorities and weigh the numbers.

Also, if you’re planning to sell before buying, check out our guide on the legal process of selling property in Kenya.

You can then walk into house-hunting with clear, confident funding.

Deciding What You Want When Looking at Properties

Before you start buying property in Kenya, it’s important to think about what fits your everyday life. This isn’t anything to do with the budget but more with what makes sense day to day.

Location

Some places look great on paper, but just don’t fit how you live. Maybe it’s the traffic. Or it’s too far out. Areas like Kitengela or Ruiru can work for people heading into the city each day. Down at the coast, Nyali is popular in the Kenyan property market with buyers who want a weekend base or rental potential.

Property Type

Each option suits a different pace of life. Apartments feel secure and usually include shared services. A house offers more privacy and space, but it also comes with added responsibility. Land lets you build your way, but that means obtaining permits and waiting longer.

New, Old, or Off-Plan

Each option comes with its own pros and risks. New builds offer a clean start, but some may have delays or incomplete paperwork. Older homes tend to be more established but may require repairs or upgrades. Off-plan units often attract buyers due to their staggered payment plans. If you’re considering an off-plan purchase, check the developer’s history, confirm they have the necessary approvals, and be clear on the expected delivery timeline.

Write a list of must-haves and nice-to-haves. It helps keep your search realistic and grounded. Check out our detailed guide on off-plan property buying in Kenya.

Viewing and Inspecting Before Buying Property in Kenya

Seeing the property in person reveals things that no listing can ever convey. Photos can hide a lot. If you live in Kenya, it’s best to visit the property yourself, but if you’re abroad, ask someone you trust to go on your behalf, and have them visit at different times. Traffic and neighbourhood noise can change completely between morning and evening.

What should you look out for?

- Look for cracks in walls and any signs of dampness.

- Loose wiring, water pressure problems, or dodgy finishes.

- The surrounding area is a massive factor. Does it feel secure? What are the neighbours like? Is the waste collection reliable?

In some cases, especially with higher-priced homes, we recommend paying a qualified inspector or surveyor to give you an honest assessment. That small cost can flag issues you’d otherwise miss.

You don’t want to end up viewing a property where the owner has painted over cracks that may reappear within weeks. A good eye for detail, or a professional, can make all the difference in finding issues like this.

Take photos, make notes, and compare properties carefully. This step could save you hundreds of thousands later.

Due Diligence – Verifying Real Estate Property and Title in Kenya

This is where buyers sometimes get caught out. Everything looks perfect until you check the paperwork. Don’t skip this part. Before making an offer, conduct a thorough background check on the property.

Start With a Title Search

You can do this through Ardhisasa online platform. It costs about Ksh 500 and shows the legal owner, any loans attached to the property, and if there’s a dispute or caution lodged against it. It’s a small fee that can save you from major legal trouble.

Double-check All Documents

Ask for the Title Deed or Certificate of Lease. Make sure the seller’s name matches their ID, and that the land reference number and location match what you saw on-site.

Watch for Unpaid Charges

For leasehold or municipal plots, check for unpaid land rates or ground rent. These often stay with the property, meaning you might inherit someone else’s bill. Ask for recent receipts.

Verify Approvals

If it’s a house, ask to see approved building plans. If it’s a new build or off-plan, check permits from the county government and NEMA. You don’t want to get stuck with homes later marked for demolition due to missing approvals.

And Always, Always Work With a Licensed Advocate

A qualified advocate with conveyancing experience knows how to spot red flags. They’ll guide you through the paperwork, confirm ownership, and protect your interests.

Making an Offer and Negotiating the Price

Once your checks come back clean and the property feels right, it’s time to make your move. In Kenya, most buyers begin with an offer letter. You usually write this yourself, or your agent or advocate does it on your behalf. This letter outlines your proposed price and any conditions.

Expect some back and forth. Negotiating is part of buying a house in Kenya. Sellers often start high, knowing buyers will negotiate. Use recent sales in the area or a valuation to back up your offer. Don’t let emotion push you past your budget, as we’ve seen people stretch too far and regret it later.

For some properties, especially those off-plan properties or newly developed, the seller may request a small reservation fee to secure the unit. Only pay this to a reputable party, and only after both sides agree to the terms in writing.

After your offer is accepted, either you, your agent, or your advocate prepares a letter of Offer to confirm the agreed terms in writing. This document outlines the proposed price, deposit amount, and payment timeline, showing that both sides intend to proceed with the sale.

However, the Letter of Offer is not legally binding. It simply reflects mutual intent, and either party can still walk away before the final sale agreement is signed.

The Legal Process (Sale Agreement to Closing)

Once the seller agrees to your price, both advocates draft a Sale Agreement. The document sets the price, payment dates, deadlines, and penalties if anyone backs out. Read every line. At signing, you pay a deposit, usually 10% into an advocate’s client account or a trusted escrow, never as loose cash.

Financing and Bank Approval

If you’re taking out a mortgage, send the signed agreement to your bank as soon as possible. The loan officer will request payslips, bank statements, and property details. The bank then orders its valuation to confirm the house’s market price. Once the numbers align, the bank issues an offer letter and collaborates with your advocate to register a charge on the title.

Valuation

To avoid overpaying or buying a risky property, it’s helpful to read our full guide on how to value your property in Kenya.

Cash buyers often skip this step, yet a licensed valuer can reveal defects or inflated prices. For a few thousand shillings, you gain peace of mind and a solid figure for insurance.

Transferring the Title

With the deposit paid and the loan (if any) approved, advocates prepare the transfer documents. For freehold property, you sign a Transfer of Land form. Leasehold land requires an assignment of the lease, along with consent from the Lands Office or the county. You supply your PIN certificate and ID to prove tax compliance and identity.

Stamp Duty and Registration

Before the Lands Registry records the new owner, you must pay stamp duty. The standard rates are 4% for properties in urban areas, 2% in rural zones, and 1% if ownership is held under a registered company and transfer is made via shares instead of a title. Your advocate raises the assessment on iTax and submits payment. The registry then updates the title with your name (and the bank’s charge, if applicable). Delays can stretch to a few months, so keep calm and check progress weekly.

Completion and Handover

After the registration finishes and the balance reaches the seller, the keys change hands. The advocate delivers your new title deed, and you own the home outright.

Buying a House in Kenya as a Foreigner

Distance or a passport shouldn’t block your Kenyan real estate plans. If you live abroad, hire an advocate and agent you trust; they become your eyes on the ground. Some buyers give power of attorney to a relative or an advocate to sign paperwork.

Foreign nationals can also purchase Kenyan property. Just note the law bars freehold land. You may hold leasehold interests, typically for up to 99 years, and apartments fall under this rule. You still need a Kenyan PIN for tax and must follow each legal step, but solid advice keeps your purchase safe.

Final Thoughts

Buying property in Kenya isn’t always simple, but it’s possible with our help. Once your finances are in order and you’ve taken the time to check the property properly, the rest starts to feel more manageable.

We’re here to help buyers with all kinds of goals. Some needed help finding a family home. Others needed someone on the ground to handle documents while they were abroad. Whatever the situation, Malluug Realty Kenya takes it seriously and stays with you through each stage.